WE ASSIST OUR CLIENTS IN IMPORTING / PURCHASING VARIOUS COMMODITIES AGAINST DOCUMENTARY LETTERS OF CREDIT. WE ALSO ASSIST OUR CLIENTS IN OBTAINING FUNDS THROUGH COLLATERALIZATION OF BANK INSTRUMENTS. WE PROVIDE PROFESSIONAL ASSISTANCE TO OUR CLIENTS WHO WANT LONG TERM PROJECT LOANS OR SHORT TERM LOANS TO FINANCE THEIR EXISTING PROJECTS THROUGH OUR CONTACT FINANCIERS. WE ALSO ASSIST IN IDENTIFICATION OF RELIABLE PROVIDERS OF LEASED BANK INSTRUMENTS UNDER ONE-WINDOW OPERATION

Saturday, January 5, 2013

DISCOUNTING OF PROMISSORY NOTES

Dear Gentlemen

Please be advised that we have developed an effective CASH MANAGEMENT PROGRAM in order for discounting of PROMISSORY NOTES issued by companies properly registered and functioning successfully in any credible jurisdiction. Under this specific discounting arrangement, such companies can raise quick funds through issuance of promissory notes which can be dated upto 3 months to 6 months from the date of their issuance.

Please find attached PN DISCOUNTING AGREEMENT for your review and understanding of terms. Please be advised that under our arrangement, PROMISSORY NOTES discounting shall be done within 15 banking days (at most) excluding postal time. Kindly be advised that all PROMISSORY NOTES must be AVAL by any good bank. In case you have any problem in BANK AVAL, we can assist in this matter. We can arrange BANK AVAL from a good bank at an affordable fixed cost (regardless of PN amount).

If you are ready, you will be required to send CIS + passport copy of the PN issuer (normally the CEO of the company).

For further details, please do not hesitate to send email to argointernationalusa@gmail.com or talk to SYED JAMALUDDIN via SKYPE.

SYED JAMALUDDIN

GERMANY

TEL +49-17632440017

SKYPE ID: jamaluddin.syed

www.argointernationalusa.blogspot.com

DISCOUNTING OF POSTDATED CHEQUES IN 15 BANKING DAYS

Dear Gentlemen

Please be advised that we have developed an effective CASH MANAGEMENT PROGRAM in order for discounting of post-dated cheques issued by companies properly registered and functioning successfully in any credible jurisdiction. Under this specific discounting arrangement, such companies can raise quick funds through issuance of post-dated cheques which can be dated upto 3 months to 6 months from the date of their issuance.

Please find attached CHEQUE DISCOUNTING AGREEMENT for your review and understanding of terms. Please be advised that under our arrangement, cheque discounting shall be done within 10 banking days (at most) excluding postal time. Kindly be advised that all post-dated cheques must be sent via MT199. In case you have any problem in sending the MT199, we can assist in this matter. We can arrange MT199 from a British bank at an affordable fixed cost (regardless of cheque amount).

If you are ready, you will be required to send CIS + passport copy of the cheque issuer (normally the CEO of the company).

For further details, please do not hesitate to send email to argointernationalusa@gmail.com or talk to SYED JAMALUDDIN via SKYPE.

SYED JAMALUDDIN

GERMANY

TEL +49-17632440017 / USA TEL +1 7632607659

SKYPE ID: jamaluddin.syed

www.argointernationalusa.blogspot.com

Thursday, January 3, 2013

FROM THE DESK OF JAMALUDDIN SYED

Regarding Bank Swift messages like MT799, MT999, and MT199, YES, it is not easy to explain quickly, clearly and why use one type or the other.

For beginners, both are classified by SWIFT as “free format message” , the difference is that for an MT799, banks must exchange a so called BKE authenticator… which means a test key is automatically coded into the sent message, and decoded at the receiving end. An MT999 is the same as MT799, just without this test code. therefore its considered unauthenticated, and MT999 messages have no value whatsoever, unless confirmed via a separate test key.

--------------------------------------------------------------------------------

SWIFT MT 799

The MT-799 is a free format SWIFT message type in which a banking institution confirms that funds are in place to cover a potential trade.

This can, on occasion, be used as an irrevocable undertaking, depending on the language used in the MT-799, but is not a promise to pay or any form of bank guarantee in its standard format.The function of the MT-799 is simply to assure the seller that the buyer does have the necessary funds to complete the trade.

--------------------------------------------------------------------------------

What does the SWIFT MT-799 option provide?

An account with the SWIFT MT-799 capability allows bank-to-bank SWIFT electronic verification for Proof of Funds in compliance with the SWIFT Category 7 “Treasury Markets & Syndication” message types.

Often there is a misconception that a particular circumstance requires a SWIFT MT760message, when in fact, the SWIFT MT-799 format provides the required bank confirmation for the application. There is a $1 million minimum account size for a SWIFT MT-799, and additional costs apply.

The MT-799 is usually issued before a contract is signed and before a letter of credit or bank guarantee is issued. After the MT-799 has been received by the seller’s bank, it is then normally the responsibility of the seller’s bank to send a POP (proof of product) to the buyer’s bank, at which point the trade continues towards commencement.

The actual payment method commonly used is a documentary letter of credit or an MT-103 (wire transfer), which the seller presents to the issuing or confirming bank along with shipping documents. Once the bank confirms the documents, the seller is then paid.

An alternative method is to use a bank guarantee in place of a letter of credit. It is normally at the seller’s discretion which method of payment is used.

--------------------------------------------------------------------------------

How Do I Issue An MT-799 Swift Message

The short answer is that you cannot. Approach your bank, and make an arrangement with them to have an MT-799 wired to the seller’s bank. Some banks are reluctant to issue MT-799’s, as these make them liable for the full cost of the trade, which can sometimes be in the millions. On the other hand, we can assist you in this matter. Just send a brief email with your specific need to argointernationalusa@gmail.com and we will do the rest for you under our specific agreement with you.

--------------------------------------------------------------------------------

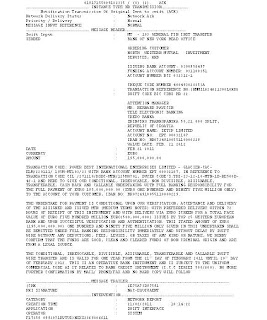

What Does A MT-799 Look Like?

An MT-799 is an automated message sent electronically from one bank to another, so you won’t really ’see’ an MT-799 at all. The paperwork associated with an MT-799 will vary from bank to bank, though most banks follow a similar format.

What does the SWIFT MT-999 option provide?

In order to know what an MT999 is; one must be familiar with an MT799, both are classified by SWIFT as “free format message” ..

The difference is that for an MT799, banks must exchange a so called BKE authenticator…which means a test key is automatically coded into the sent message, and decoded at the receiving end. An MT999 is the same, just without this test code. therefore it’s considered unauthenticated, and MT999 messages have no value whatsoever, unless confirmed via a separate test key.

--------------------------------------------------------------------------------

What is Swift MT199 Message bank letter?

A Swift Message Type 199 Is A Interbank Message Used Between Two Banks To Transmit The Value Of A Bond Or An Skr Or A Free Format Message Engaging 2 Banks Readyness To Move Forward With A Transaction. Usually A Private One.

A Mt199 Swift Message Is Easily Explained As A “Chat” Message.

Basically You Use This Format

■When A Transfer Order Has Been Sent And You Want To “Notify” The Beneficiary Bank In Order To Sort Out Something,

■Or To Find Out If Funds Have Been Applied,

■Or Basic Other Info.

For Example, A Mt199 Could Go;

We Refer To Our Mtxxx, Date Xxxxxx,

(Input Information Regarding The Orderer And Beneficiary. Amount, Dates, And So On)

And Then, Straight To The Point, You Just Simply Type The Text Of Your Question, Or Demand, Or Whatever, Like, “Our Customer Reports Funds

Have Not Been Applied Yet, Please Confirm Transfer Status”

Kind Regards, (Whoever)

The Other Bank Will Reply To You Using The Same Format (Most Likely), So Sooner Or Later, You Will Have An Incoming Mt199 From Them, Like;

We Refer To Your Mt199 Date Xxxxx And Our Mtxxx Date Xxxx Information, Codes, Etc…

“We Are Holding Funds, Request (Whatever Additional Information) In Order To Apply Funds To Beneficiary Minus Our Charges.

Please Confirm Iban Number (For Example).”

So Basically, A Mt199 Is One Banker Or Security Officer “Talking” To Another.

Subscribe to:

Posts (Atom)